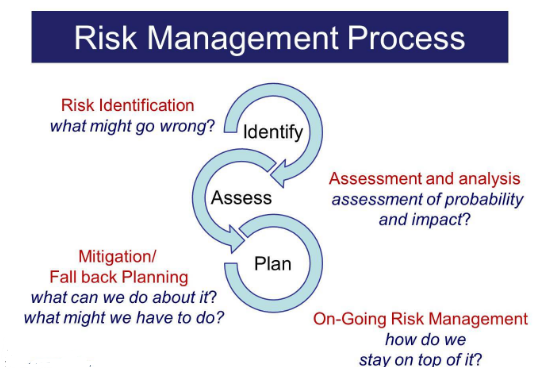

Risk management in the supply chain of a rapidly growing business involves the systematic identification, assessment, mitigation, and monitoring of potential risks that could impact the smooth flow of goods, services, and information within the business's supply chain as it experiences rapid expansion. This process aims to minimize disruptions, optimize performance, and ensure the business can effectively respond to unforeseen challenges.

Here's a comprehensive overview of how to approach risk management in this context:

Identify Risks:

This step involves recognizing all potential risks that could affect the supply chain. These risks can include demand fluctuations, supplier issues, transportation disruptions, regulatory changes, natural disasters, geopolitical instability, and more. Engage your team and external experts if needed to comprehensively identify risks.

The goal of risk identification is not only to identify every possible risk but also to prioritize them based on their potential impact and likelihood. A comprehensive understanding of potential risks enables the business to allocate resources effectively for risk mitigation and response strategies. Visit this website for risk identification help online free chat now!

Assess Impact and Likelihood:

For each identified risk, assess its potential impact on your supply chain operations and the likelihood of occurrence. This step helps prioritize which risks require immediate attention and which can be managed with less urgency.

Impact refers to the magnitude of the consequences that a specific risk event could have on the supply chain and, consequently, the business's operations, reputation, and financials. When assessing impact, consider the following factors:

- Financial Impact: Estimate the potential costs associated with a risk event. This could include direct costs such as production disruptions, increased transportation expenses, or fines, as well as indirect costs like lost sales, decreased customer satisfaction, and damage to brand reputation.

- Operational Impact: Determine how a risk event might affect the day-to-day functioning of the supply chain. Will it disrupt production, lead to delays in delivery, or cause inefficiencies in processes?

- Reputational Impact: Consider how the risk event could impact the business's image and reputation among customers, partners, and stakeholders. Negative publicity or recurring supply chain issues can erode trust and customer loyalty.

- Regulatory and Legal Impact: Assess potential legal and compliance ramifications that could arise from a risk event, such as violations of regulations or breaches of contracts.

- Strategic Impact: Examine whether the risk event could derail the business's long-term plans, expansion goals, or market positioning.

Likelihood refers to the probability or chance that a specific risk event will occur within a given timeframe. Evaluating likelihood involves analyzing various factors that contribute to the probability of the risk event happening:

- Historical Data: Review historical data and past occurrences of similar events to identify patterns and trends that might indicate the likelihood of a specific risk.

- External Factors: Consider external factors that could increase or decrease the likelihood of the risk event, such as economic conditions, geopolitical stability, regulatory changes, and weather patterns.

- Market Intelligence: Stay informed about industry trends and developments that could impact the likelihood of certain risks materializing.

- Internal Controls: Evaluate the effectiveness of internal controls and mitigation measures that are already in place to prevent or manage risks. Strong controls can lower the likelihood of certain events occurring.

- Expert Judgment: Seek input from subject matter experts and stakeholders who have experience in the industry or specific risk area. Their insights can provide a more informed perspective on the likelihood of certain events.

To assess impact and likelihood effectively, many businesses use a risk assessment matrix. This matrix categorizes risks based on their impact and likelihood, which helps prioritize them for mitigation efforts. Risks with high impact and high likelihood should be addressed urgently, while those with low impact and low likelihood may receive lower priority.

Risk assessment is not an exact science and involves some degree of subjectivity. It's important to continually refine your assessment based on new data, insights, and experiences to ensure that your risk management strategies remain accurate and effective over time.

Risk Mitigation Strategies:

Risk mitigation strategies involve proactive measures taken to reduce the impact of potential risks on the supply chain of a rapidly growing business. These strategies are designed to minimize the likelihood of disruptions and enhance the organization's ability to respond effectively when challenges arise. Here are some specific risk mitigation strategies:

- Diversified Supplier Base: Work with multiple suppliers to reduce the impact of a single supplier's failure.

- Supply Chain Visibility: Implement systems to monitor and track the movement of goods throughout the supply chain.

- Safety Stock: Maintain an appropriate inventory buffer to counter unexpected disruptions.

- Demand Forecasting: Use accurate demand forecasting to minimize overstocking and understocking risks.

- Collaboration and Communication: Foster strong relationships with suppliers, fostering open communication and collaboration to address issues proactively.

So, what is the best risk mitigation strategy, and how can one use risk mitigation strategies wisely?

Contingency Planning:

Develop contingency plans for high-impact risks that could severely disrupt your supply chain. These plans outline step-by-step actions to take in case a risk materializes. Ensure these plans are well-documented, understood by key personnel, and regularly updated.

By having well-prepared contingency plans in place, a rapidly growing business can navigate disruptions with more confidence, minimize downtime, maintain customer satisfaction, and mitigate potential financial losses.

Technology Integration:

Leverage technology solutions, such as supply chain management software, to monitor and manage risks more effectively. Advanced analytics and data-driven insights can help you anticipate potential issues and respond promptly.

By technology integration, a rapidly growing business can enhance its ability to anticipate, identify, and respond to potential disruptions, ensuring the efficient and reliable flow of goods and services even in the face of challenges.

Supplier Assessment:

Regularly assess the financial stability, operational capabilities, and risk management practices of your suppliers. Consider implementing supplier audits or evaluations to ensure they meet your standards.

By conducting comprehensive supplier assessments, a rapidly growing business can make informed decisions about its supplier partnerships, proactively identify and address potential risks, and build a more resilient and adaptable supply chain that supports sustained growth

Scenario Planning:

Engage in scenario planning exercises to simulate the impact of different risk events on your supply chain. This helps you understand potential vulnerabilities and make informed decisions on risk mitigation strategies.

Employee Training:

Train your team on risk management protocols, including how to identify early warning signs and execute contingency plans. Empower your employees to play an active role in risk management.

Continuous Monitoring:

Risks and their landscape evolve over time. Regularly review and update your risk management strategies to adapt to new challenges and opportunities.

Collaboration with Stakeholders:

Engage with key stakeholders, including suppliers, customers, and logistics partners, to collectively address risks and find collaborative solutions.

Insurance and Contracts:

Consider relevant insurance policies and contractual agreements that provide protection against supply chain disruptions. Legal safeguards can help mitigate financial losses.

Having appropriate insurance coverage can help a rapidly growing business recover more quickly from disruptions and reduce the financial strain associated with unexpected events. Properly drafted contracts provide a legal framework that helps manage expectations, reduces ambiguity, and ensures all parties are aware of their roles and responsibilities. This clarity can prevent misunderstandings and disputes, thereby enhancing the reliability and stability of the supply chain.

In summary, insurance and contracts work together to create a comprehensive risk management strategy for a rapidly growing business. Insurance offers financial protection against various risks, while contracts establish clear guidelines for interactions with suppliers and partners, ensuring that potential disruptions are anticipated and managed effectively.

Learning from Incidents:

When a disruption occurs, conduct a thorough post-mortem analysis to understand the root causes, how well your risk management strategies worked, and how you can improve in the future.

The risk management process is an ongoing endeavor, especially in a rapidly growing business. Flexibility, adaptability, and a proactive mindset are key to effectively managing risks and ensuring the resilience of your supply chain.