Common Strategic Analysis Tools

Strategic Analysis Tools are essential methodologies and frameworks used by organizations to assess and evaluate their internal and external environment, helping them make informed decisions and develop effective strategies. These tools provide valuable insights into various aspects of a business, industry, or market, enabling companies to identify strengths, weaknesses, opportunities, and threats.

Some of the most commonly used strategic analysis tools include:

SWOT Analysis

This tool evaluates an organization's internal Strengths and Weaknesses, as well as external Opportunities and Threats. It helps in understanding the current position of the business and aids in devising strategies that align with the company's capabilities and market opportunities.. The name "SWOT" is an acronym for the four key elements it examines:

Strengths: These are the internal positive attributes and resources that give an organization a competitive advantage over its competitors. Strengths could include factors such as a strong brand reputation, skilled workforce, advanced technology, efficient processes, unique products or services, loyal customer base, or strong financial position.

Weaknesses: These are the internal factors that place an organization at a disadvantage or hinder its performance compared to others. Weaknesses may include inadequate resources, outdated technology, poor customer service, lack of brand recognition, high production costs, or internal inefficiencies.

Opportunities: These are external factors in the business environment that could be leveraged to the organization's advantage. Opportunities may arise from market trends, changes in regulations, emerging technologies, untapped markets, collaborations, or changing customer needs and preferences.

Threats: These are external factors that could potentially harm the organization's performance or viability. Threats might come from increased competition, economic downturns, changing consumer behavior, new regulations, disruptive technologies, or natural disasters.

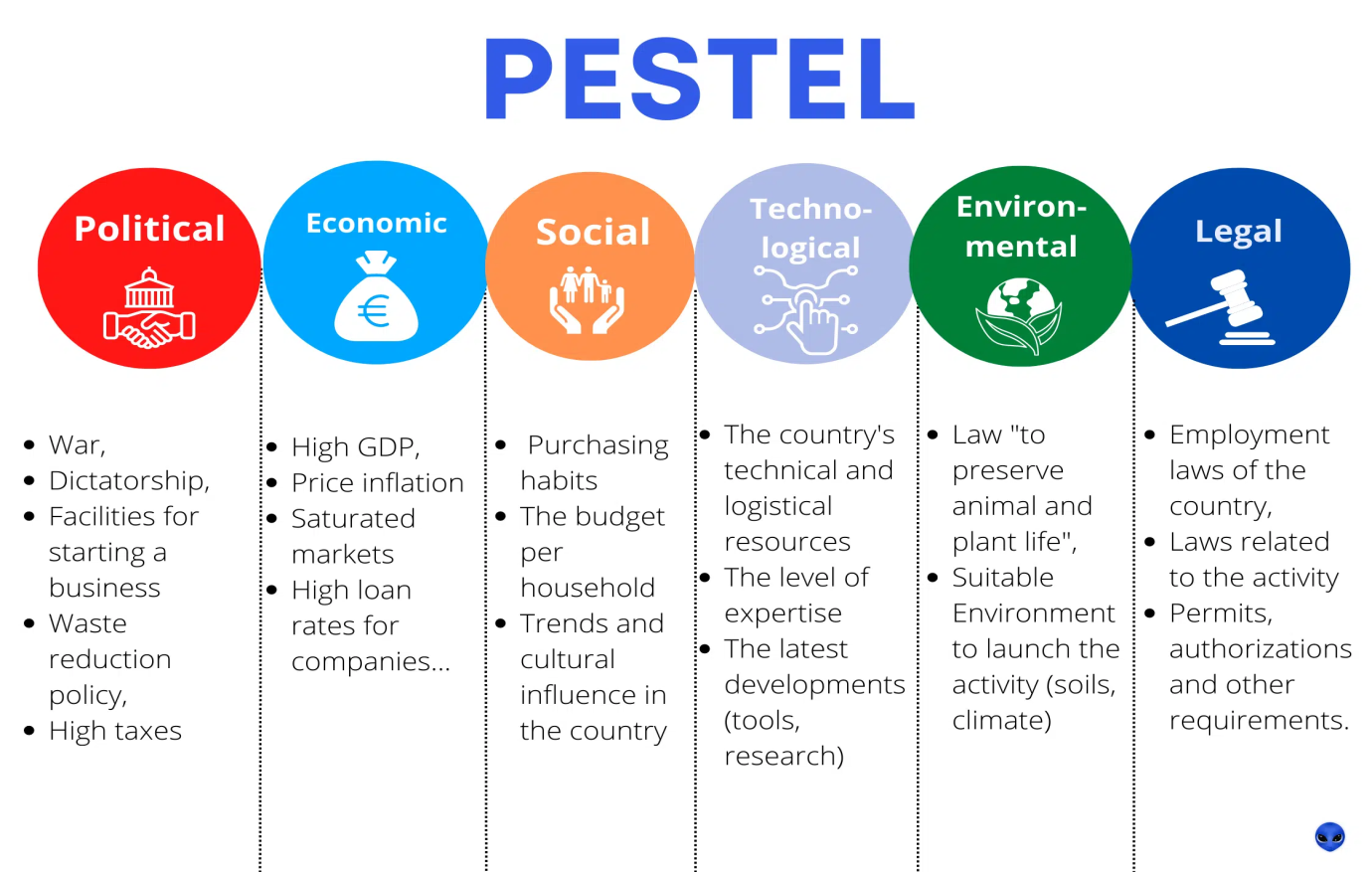

PESTEL Analysis

PESTEL Analysis, also known as PESTLE Analysis, is a strategic tool used to evaluate and understand the macro-environmental factors that can impact an organization, industry, or market. It provides a comprehensive framework for assessing the political, economic, social, technological, environmental, and legal factors that can influence a company's operations and decision-making.

Let's explore each element of PESTEL Analysis in detail:

Political Factors: These factors refer to the influence of government and political institutions on a business. This includes government policies, regulations, stability, trade restrictions, taxation policies, and political stability. Political factors can significantly impact industries such as healthcare, energy, transportation, and defense, as well as companies operating internationally.

Economic Factors: Economic factors encompass the economic conditions, trends, and indicators that affect a business. This includes factors such as economic growth rates, inflation, exchange rates, interest rates, unemployment levels, and consumer spending patterns. Economic factors can have a profound impact on consumer purchasing power, demand for products and services, and overall business profitability.

Social Factors: These factors focus on societal and cultural influences on a business. Social factors include demographic trends, population growth, lifestyle changes, attitudes towards work and leisure, education levels, and cultural norms. Understanding social factors is crucial for businesses to tailor their products, marketing strategies, and customer engagement to meet the needs and preferences of their target audience.

Technological Factors: Technological factors pertain to advancements and innovations in technology that can shape industry dynamics and organizational processes. This includes developments in automation, digitalization, artificial intelligence, research and development, and the rate of technological obsolescence. Organizations must stay abreast of technological changes to remain competitive and seize new opportunities.

Environmental Factors: Environmental factors involve the impact of ecological aspects on business operations and sustainability. This includes factors like climate change, environmental regulations, resource availability, ecological concerns, and corporate social responsibility efforts. Businesses are increasingly under pressure to adopt environmentally friendly practices and address ecological challenges.

Legal Factors: Legal factors encompass the laws, regulations, and legal frameworks that businesses must adhere to. This includes employment laws, health and safety regulations, intellectual property rights, trade restrictions, and contract laws. Non-compliance with legal requirements can lead to financial penalties and reputational damage.

Porter's Five Forces

Porter's Five Forces is a powerful framework developed by Michael E. Porter to analyze the competitive forces within an industry. The model helps businesses understand the attractiveness and profitability of an industry by examining the five key forces that influence competition and shape a company's strategic decisions. The five forces are as follows:

Threat of New Entrants: This force assesses the likelihood of new companies entering the industry and competing with existing players. The easier it is for new entrants to enter the market, the higher the competitive pressure. Factors that influence the threat of new entrants include barriers to entry, economies of scale, brand loyalty, access to distribution channels, and government regulations. High barriers to entry can create a more favorable environment for existing companies, whereas low barriers can lead to increased competition.

Bargaining Power of Buyers: This force considers the power of customers (buyers) to influence the industry. When buyers have substantial bargaining power, they can demand lower prices, higher quality products, or better services, putting pressure on industry participants. Factors that influence buyer power include the concentration of buyers relative to sellers, the availability of alternative products or services, and the importance of a particular industry's product to buyers.

Bargaining Power of Suppliers: This force assesses the power of suppliers to influence the industry. When suppliers have significant bargaining power, they can raise prices or reduce the quality of inputs, impacting the profitability of industry players. Factors that influence supplier power include the concentration of suppliers relative to buyers, the uniqueness of the supplied product or service, and the availability of substitute inputs.

Threat of Substitute Products or Services: This force examines the likelihood of customers switching to alternative products or services outside the industry. When there are many substitutes available, it puts pressure on industry participants to differentiate their offerings and provide unique value to customers. Factors that influence the threat of substitutes include the availability of close substitutes, the price-performance trade-off, and the switching costs for customers.

Rivalry Among Existing Competitors: This force looks at the intensity of competition among existing companies within the industry. High rivalry often leads to price wars, aggressive marketing, and reduced profitability. Factors that influence rivalry include the number of competitors, industry growth rate, fixed costs, product differentiation, and exit barriers. Industries with intense competition may experience low-profit margins, while industries with fewer competitors may have higher profitability.

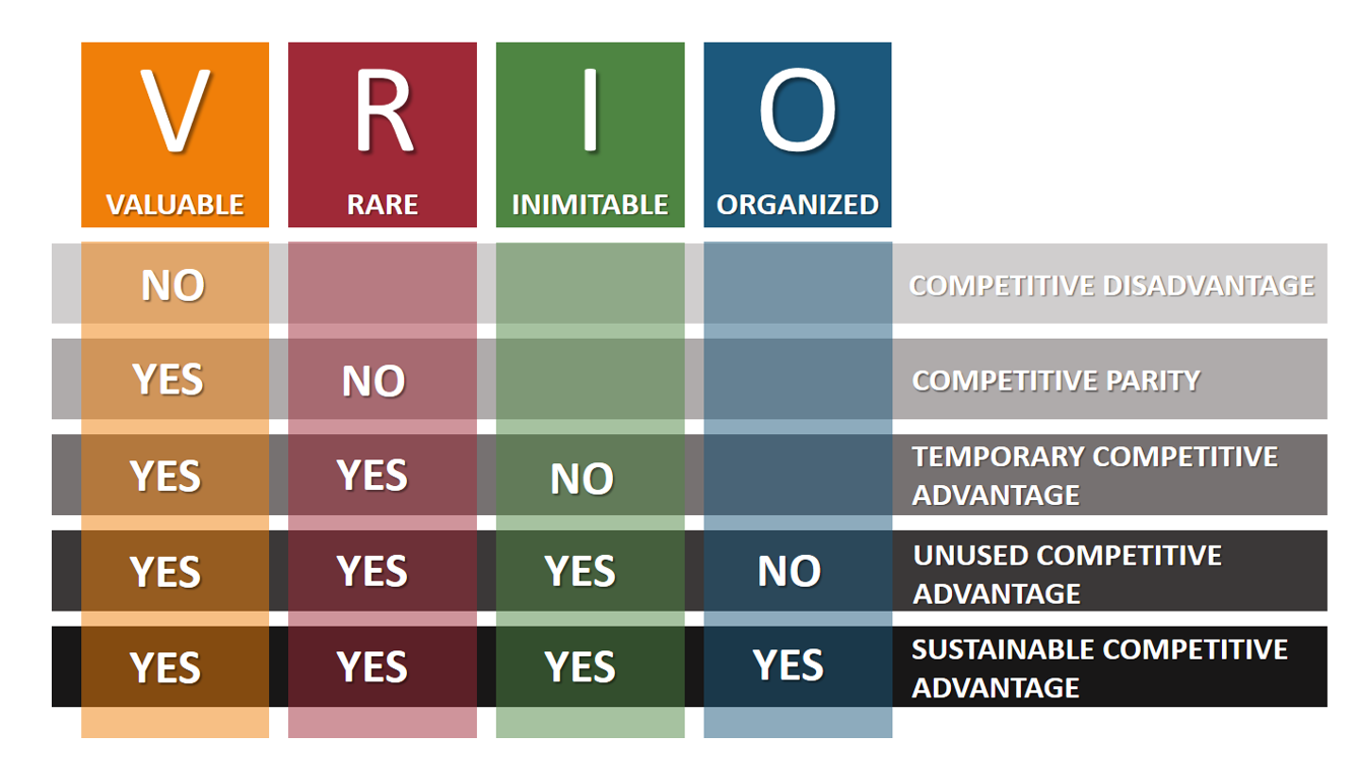

VRIO Framework

VRIO is a framework used to analyze a firm's internal resources and capabilities to determine its competitive advantage and potential for sustained competitive advantage. It stands for Value, Rarity, Imitability, and Organization. The VRIO framework helps businesses identify which resources and capabilities give them a competitive edge and whether these advantages can be maintained over time. Let's explore each element of the VRIO framework:

Value: This dimension assesses whether a firm's resources and capabilities provide value and contribute to its ability to exploit opportunities or overcome threats in the marketplace. A resource or capability is considered valuable if it enables the company to create value for customers, increase efficiency, reduce costs, or improve performance. If a resource does not provide any real value, it may not lead to a sustained competitive advantage.

Rarity: Rarity refers to the scarcity of a resource or capability relative to competitors in the industry. If a resource is rare or unique to a firm, it can be a source of competitive advantage. Resources that are widely available to all competitors in the industry may not provide a distinct advantage. Rarity is a critical factor in determining the potential for gaining a competitive edge.

Imitability: Imitability assesses the ease with which competitors can replicate or imitate a firm's valuable and rare resources or capabilities. Resources that can be easily imitated are less likely to lead to a sustained competitive advantage. On the other hand, resources that are difficult to replicate or protected by patents, copyrights, or other barriers to entry can offer a more sustainable advantage.

Organization: This dimension evaluates how well a firm is organized and able to exploit the value, rarity, and inimitability of its resources and capabilities. Even if a firm possesses valuable, rare, and hard-to-imitate resources, it needs to have the organizational structure, culture, and management systems to effectively leverage these advantages in the marketplace.

These strategic analysis tools serve as powerful instruments for decision-makers to understand their business environment, assess potential risks, identify growth opportunities, and formulate effective strategies to stay competitive and achieve long-term success.